Falls | November 27, 2023

There’s an ideal world out there. Or least an idealized one.

Consumer package goods do BASES tests to gauge demand for potential new products. Large financial services firms dig into deep pockets to conduct exhaustive research. Innovative companies with a particular type of DNA see the horizon beyond the horizon – so successfully positioning a brand to respond to market shifts is just another day at the office.

But most brand marketers don’t live in this world.

Meeting this month’s deadlines might be higher on the To Do list than spotting trends for a to-be-determined quarter. When your boss is screaming “why don’t we have one of those products”, even the most experienced manager can be swayed by emotion rather than ROI. And while brands demonstrably create value for corporations and non-profits, evolving a brand for tomorrow is predicated on the idea that one fully understands where the brand is today – and not everyone does.

Let’s start with a definition.

At Falls & Co., we believe that a brand is a promise that creates a preference, as Landor Associates’ Walter Landor said. In this world view, a consumer has accepted your offer because your brand meets a functional and/or emotional need. Stated differently, your brand is as or more relevant than other brands. But across a wide range of categories, brands start making new promises. If you think that entire industries being built on rapid response and other categories changing willy nilly, consider these examples:

- Zara’s business model, like other brands in the fast fashion industry, is anchored in its ability to respond to shifts in clothing sensibilities. You walk into H&M to score what was hot at a recent Paris fashion show. Last season? That’s so meh.

- Sriracha, as both a product and as an ingredient for products, moved from a loved place on the table of neighborhood Asian restaurants to a ubiquity approaching pumpkin spiced fill-in-the-blank. By the time a trend is near ubiquity, you can go with the crowd to, possibly, establish a Point of Parity or stick to your business model. Right now, how many brands are thinking about bringing something Sriracha-related to market? And how many of those do you think will be successful?

- Our Place saw an opportunity in the kitchen gadget category to be more inclusive – as can be seen by visiting their site versus what Williams-Sonoma or Sur La Table have up. From a branding perspective, it’s a relevant Point of Differentiation (POD). Long-term success might turn on how the business model can support that POD.

And if you think that working in a less-than-sexy industry such as logistics means you don’t have to worry about evolving your brand’s promise, think again.

A well-established response to these type of changes is to evolve your brand from evolutionary shifts such as refreshing your brand to revolutionary moves such as changing your core product. Interestingly, Pepsi’s was both a cosmetic change and a strategic decision to signal that Pepsi decreased the sugar in its core product by 57%.

Sometimes responding to a category shift is a no-brainer in terms of whether you should and, if so, how. Offering free Wi-Fi in the mid-tier hotel category went from being a Point of Difference to a Point of Parity faster than you can say “so, I wonder what’s on Netflix tonight?”.

But decisions aren’t always as clear-cut in the not-ideal world. How do you decide?

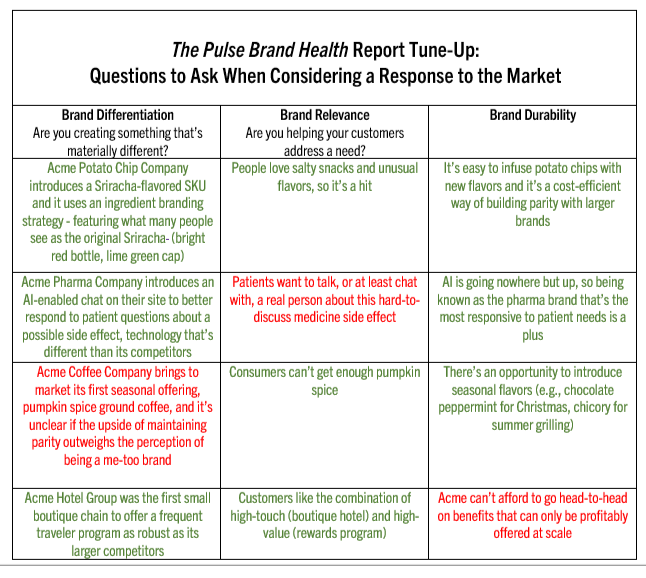

At Falls & Co., we determine brand health – the ability to make and keep a promise – based on three externally focused factors (Brand Differentiation, Brand Relevance, and Brand Durability) and three internally focused factors (Brand Alignment, Brand Consistency, and Brand Experience). The three externally focused drivers can help you map a response to your changing category.

Brand Differentiation: Healthy Brands are Distinct.

Are you creating something that’s materially different? Or are you just keeping up with the Joneses?

Brand Relevance: Healthy Brands Solve Customers’ Problems.

Are you helping your customers address a need?

By one estimate, 90% of startups fail, with the No. 1 reason being the lack of a product/market fit. And while it’s difficult to nail down why a large percentage of the 25,000 yearly new products introduced every year fail, it’s reasonable to assume those brands’ managers work in the less-than-ideal world of imperfect (often, at best) information about current brand equity, market shifts, and potential brand evolutions.

Brand Durability: Healthy Brands are Built for the Long-Haul.

Will an evolution create long-term brand value?

Perhaps you’re the manager of a smaller CPG that wants to remain relevant by introducing new flavors, not at the torpid pace of Reese’s but a bit more market-centric than Tootsie Roll. Does a Mexican chocolate-infused Tootsie Roll linked to a Cinco de Mayo make sense? Or are you setting yourself up for a pattern you can’t continue?

The three external drivers of brand health, illustrated here as hypothetical scenarios, shows how real-world managers can make strategy-based decisions.

If you’re interested in establishing a foundation on which to build a change strategy, please contact us about The Pulse Brand Health Report. If you have a good sense of what your brand’s promise is but are stuck on what’s next, we can help with The Solve™ Brand Development Lab.